All Categories

Featured

Table of Contents

Getting rid of agent settlement on indexed annuities permits for dramatically higher illustrated and actual cap prices (though still significantly less than the cap prices for IUL plans), and no uncertainty a no-commission IUL policy would certainly push illustrated and real cap rates greater too. As an aside, it is still possible to have an agreement that is very abundant in representative settlement have high very early cash money abandonment values.

I will certainly concede that it is at the very least in theory feasible that there is an IUL policy out there issued 15 or two decades ago that has actually delivered returns that transcend to WL or UL returns (a lot more on this below), yet it's vital to much better understand what a proper contrast would entail.

These plans typically have one bar that can be evaluated the company's discretion each year either there is a cap rate that defines the optimum crediting price because particular year or there is an involvement rate that specifies what portion of any kind of favorable gain in the index will be passed along to the plan in that certain year.

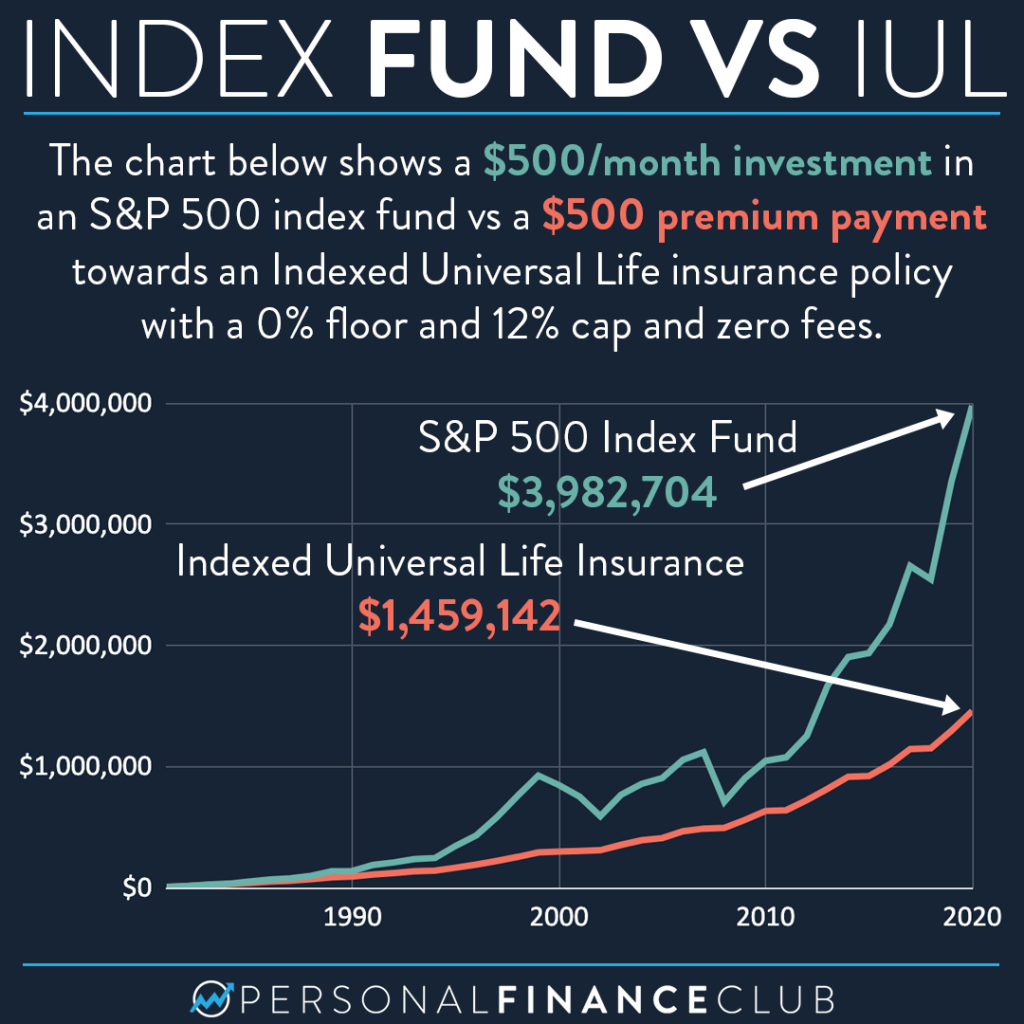

And while I typically concur with that characterization based on the technicians of the plan, where I disagree with IUL proponents is when they characterize IUL as having superior returns to WL - life insurance stock market. Many IUL advocates take it a step further and factor to "historical" data that seems to sustain their cases

There are IUL policies in presence that bring even more risk, and based on risk/reward principles, those plans need to have higher expected and actual returns. (Whether they in fact do is a matter for significant argument yet business are using this technique to assist warrant higher illustrated returns.) For instance, some IUL plans "double down" on the hedging method and evaluate an added cost on the policy annually; this cost is then used to enhance the choices budget plan; and afterwards in a year when there is a positive market return, the returns are amplified.

Best Iul Insurance Companies

Consider this: It is feasible (and as a matter of fact likely) for an IUL plan that averages a credited rate of say 6% over its very first one decade to still have a total adverse price of return throughout that time as a result of high charges. Lots of times, I find that agents or customers that brag about the performance of their IUL plans are confusing the credited price of return with a return that effectively reflects all of the policy charges.

Next we have Manny's question. He states, "My buddy has actually been pressing me to acquire index life insurance policy and to join her organization. It looks like a Multi level marketing.

Insurance policy salesmen are not bad people. I used to offer insurance policy at the beginning of my career. When they market a costs, it's not unusual for the insurance coverage business to pay them 50%, 80%, even often as high as 100% of your first-year costs.

It's difficult to sell because you obtained ta always be looking for the following sale and mosting likely to locate the next individual. And especially if you do not really feel very founded guilty regarding the important things that you're doing. Hey, this is why this is the most effective solution for you. It's going to be hard to discover a great deal of satisfaction because.

Allow's speak regarding equity index annuities. These things are prominent whenever the markets are in an unpredictable period. You'll have abandonment durations, typically seven, 10 years, possibly also past that.

Iul Agent Near Me

Their abandonment periods are significant. That's how they recognize they can take your cash and go totally invested, and it will certainly be okay due to the fact that you can't obtain back to your cash till, once you're into seven, 10 years in the future. That's a long-term. No matter what volatility is taking place, they're possibly going to be great from an efficiency standpoint.

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your hectic life, monetary independence can seem like a difficult goal.

Fewer employers are using typical pension plan strategies and several business have actually minimized or discontinued their retirement strategies and your ability to count entirely on social safety and security is in inquiry. Even if advantages haven't been reduced by the time you retire, social protection alone was never ever meant to be adequate to pay for the lifestyle you want and deserve.

Fidelity Iul

Now, that may not be you. And it's important to know that indexed global life has a whole lot to supply individuals in their 40s, 50s and older ages, along with individuals that want to retire early. We can craft a remedy that fits your details circumstance. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Currently, expect this 35-year-old man needs life insurance policy to shield his family and a way to supplement his retirement earnings. By age 90, he'll have gotten almost$900,000 in tax-free income. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And ought to he pass away around this time around, he'll leave his survivors with more than$400,000 in tax-free life insurance advantages.< map wp-tag-video: Text boxes show up that read"$400,000 or even more of security"and "tax-free income with policy lendings and withdrawals"./ wp-end-tag > Actually, throughout every one of the build-up and disbursement years, he'll get:$400,000 or even more of protection for his heirsAnd the possibility to take tax-free income with policy lendings and withdrawals You're possibly asking yourself: Exactly how is this possible? And the solution is easy. Interest is linked to the performance of an index in the stock exchange, like the S&P 500. However the money is not directly invested in the securities market. Passion is attributed on an annual point-to-point sectors. It can provide you extra control, adaptability, and choices for your monetary future. Like lots of people today, you may have accessibility to a 401(k) or various other retirement. Which's a great initial step towards saving for your future. Nevertheless, it is very important to comprehend there are restrictions with certified strategies, like 401(k)s.

And there are constraints on when you can access your money without penalties. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a qualified strategy, the cash can be taxable to you as earnings. There's a great factor so numerous individuals are turning to this special service to resolve their financial goals. And you owe it to on your own to see how this could benefit your own personal situation. As part of a sound economic technique, an indexed global life insurance plan can aid

Universal Life 保险

you take on whatever the future brings. And it uses one-of-a-kind possibility for you to construct substantial cash worth you can make use of as additional income when you retire. Your cash can grow tax postponed via the years. And when the plan is made properly, distributions and the death advantage will not be tired. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is very important to speak with an expert agent/producer that recognizes how to structure a service similar to this correctly. Prior to dedicating to indexed universal life insurance, here are some advantages and disadvantages to think about. If you select a great indexed global life insurance policy strategy, you might see your cash worth grow in value. This is practical due to the fact that you may have the ability to accessibility this cash prior to the strategy runs out.

Since indexed global life insurance coverage needs a certain level of danger, insurance firms have a tendency to maintain 6. This type of strategy additionally offers.

Typically, the insurance coverage company has a vested passion in doing better than the index11. These are all factors to be taken into consideration when picking the best kind of life insurance for you.

Because this kind of plan is extra intricate and has a financial investment element, it can frequently come with greater premiums than various other plans like whole life or term life insurance policy. If you do not think indexed universal life insurance policy is best for you, below are some choices to consider: Term life insurance policy is a short-lived policy that typically provides protection for 10 to three decades.

Cost Of Insurance Universal Life

When making a decision whether indexed universal life insurance coverage is best for you, it is necessary to think about all your alternatives. Whole life insurance policy may be a much better option if you are seeking even more security and consistency. On the other hand, term life insurance policy may be a far better fit if you only need coverage for a particular amount of time. Indexed universal life insurance policy is a sort of policy that supplies more control and versatility, along with higher money worth development potential. While we do not supply indexed universal life insurance policy, we can supply you with more info concerning entire and term life insurance policy policies. We recommend checking out all your choices and talking with an Aflac representative to discover the finest fit for you and your family.

The rest is contributed to the cash worth of the plan after costs are deducted. The money value is credited on a regular monthly or yearly basis with passion based upon boosts in an equity index. While IUL insurance coverage might show useful to some, it's vital to understand just how it works before acquiring a plan.

Table of Contents

Latest Posts

Iul Life Insurance Vs Whole Life

Life Insurance Surrender Cost Index

Irl Insurance

More

Latest Posts

Iul Life Insurance Vs Whole Life

Life Insurance Surrender Cost Index

Irl Insurance